Who needs a Broker's Price Opinion form?

Any person interested in selling or buying real estate can order evaluation of property of their interest. This assessment is carried out by the appraiser using the BPO form. Also, this real estate appraisal could be performed for transactions related to obtaining credit or changing its conditions.

What is Broker's Price Opinion form for?

This form gives the idea of the overall condition of the property and its value. All the types of repairs that must be done are taken into account. Also, the interior BPO form contains reviews of a competing property and several deals closed in the area. This information allows estimation not only of the property itself, but also of the overall situation in the real estate market in the area.

Is Broker's Price Opinion form accompanied by other forms?

The Drive-by BPO form in not accompanied by any other forms.

When is Broker's Price Opinion form due?

Expiration term of this evaluation — six months. In case of such a long period, you have to consider that the assessment may not reflect the actual state of the object.

How do I fill out Broker's Price Opinion form?

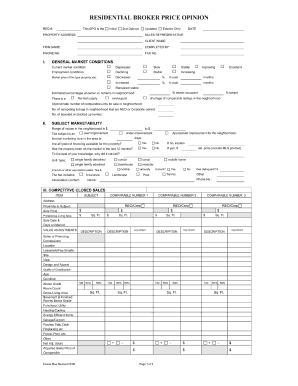

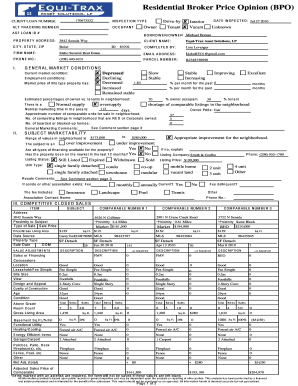

This fillable BPO template contains the following points to be filled out:

- Subject property description;

- Estimate of repairs needed for subject property;

- Neighborhood review;

- Value Estimation;

- Competitive listing and closed sales.

Where do I send Broker's Price Opinion form?

Completed Broker’s Opinion should be directed to the property owner.